Understanding a Comparative Market Analysis in Real Estate

Understanding a Comparative Market Analysis in Real Estate

A Comparative Market Analysis (CMA) is a critical tool in helping buyers and sellers determine a price for a home. This essential report provides an estimated market value for a property by comparing it to recently sold similar homes in the area. But what exactly is a CMA, how do you interpret its findings, and how does it differ from a formal appraisal? This blog post will break down everything you need to know about CMAs, from understanding the key components and reading the data to recognizing its limitations and distinguishing it from a professional appraisal, empowering you to make informed decisions in your real estate journey.

Key Takeaways

- A CMA is a report built by realtors to give data into pricing a home effectively to the current market.

- Key things to look for in a CMA are square foot, bed, bath, price / square foot and # of Days on Market

- Appraisals are more accurate than a CMA but cost hundreds of dollars and may not be the right tool to use in all circumstances.

What is the Purpose of a CMA?

A CMA is the primary tool used to help provide buyers with data to make an informed offer price and sellers a fair list price. A CMA will list out similar houses that have sold in the same neighborhood and how much they sold for in order to help determine what a market is currently valueing similar homes. That being said there are several things both buyers and sellers will look at on a CMA that vary and you should be aware of what the other side is thinking as you negotiate with your real estate agent to accomplish your goal. How do buyer's and seller's use a CMA differently?

Buyers:

- Fair Price: Buyers will use this data to help them determine an offering price

- Negotiate: Buyers will use a CMA as they negotiate to know if their offer is competitive.

- Avoid Overpaying: This will guide the buyer on when to move on or keep pressing.

Sellers:

- Fair List Price: Where should we set the initial asking price?

- Upgrades: Which repairs will yield different types of returns?

- Days On Market: Based on the price what is the average number of days a property sat on the market? This is important to sellers as they may carry other costs like mortgage, taxes, insurance, utilities that all add up if they have already moved out. Pricing is one of the biggest drivers to # of days on market.

As a buyer you need to be attentive of the goals of the seller and as a seller you may want to look at additional ways you could provide value to prospective buyers that help them lower things like out of pocket cash.

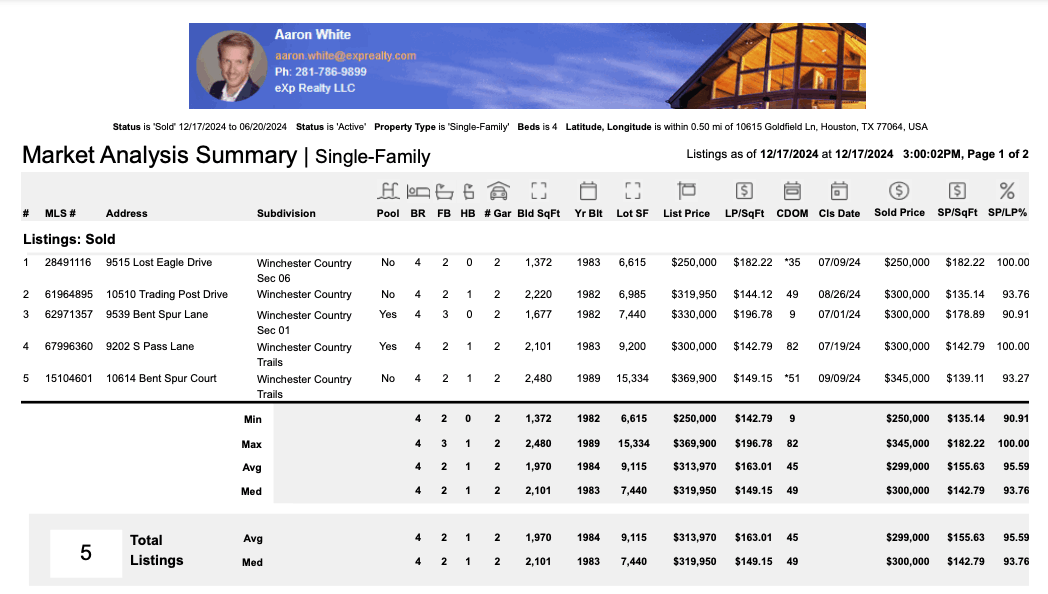

How to Read a CMA in Real Estate?

Your Katy, TX realtor will guide you through a specific CMA in more detail as there is often a number of knobs they tweaked to build your CMA. It is important you understand what they found and why they picked the houses they did to go in your report. Once they have taken you through this there are several things you will want to look at.

- Square Footage & Lot Size: Make sure you are looking at a similar home. If you are looking at homes with ranges from 1,000- 3,000 sqft then these are not comparable homes. Your pricing decision will be poorly informed as you are looking at demand for very different sizes of homes in that market.

- Bedroom and Bathroom #: Similar to square footage we want to dial this in as much as possible.

- Days On Market: If you see a corelation with higher price and higher days on market then this can help a seller determine how long they are willing to wait for an offer to come in and can heavily influence their pricing.

- Sold Price/ Square Foot: As home will vary a lot in size this number will help us apply a value to a home that isn't 100% the same size. For example if I see a home with 1350 square feet is active I can apply an average price per square foot for similar sized homes in the area to 1350 and arrive at an estimated value.

- Photos: If there are big swings in the price/ square foot then it is important your realtor do some digging to show you pictures and read into the disclosures to determine if there are any reasons to the bing variances.

Which is More Accurate, A CMA or an Appraisal And Why?

An appraisal is a more accurate estimate of market valuation. What are the limitations of sales comparison approach? There are a few things to look at here.

- Appraiser is unbiased: They have no relationship with the buyer or seller. They represent the financial interests of the lender.

- Appraisers are Licensed: In Texas, an appraiser must approach appraisals by the rules and methods established by the state of Texas. Realtors don't have established rigorous methodologies by the state.

- Appraisers use Multiple Valuation Approaches: They might look at comparable sales like a CMA but they also look at cost approach for freshly renovated homes or new construction. They may also look at income a property may generate and they may award a value based on what the market is paying for similar income producing homes.

- Appraisers Reconcile Values: They can use a mathematical approach to reconciling the valuations from multiple approaches.

- Construction Materials: Appraisers will also dive into upgrades and construction materials used when determining a home value. If there is market evidence that specific materials return better pricing they will take this into account.

- Obsolescence: Appraisers will look at functional and external obsolecence on a property to see things that may detract from a home's value. They will look for similar supporting data to help them inform how this impacts pricing.

- Reporting: Appraisers are required to follow state guidelines on reporting the appraisal and showing what data they used to arrive at their valuation report.

Why doesn't everyone use an appraisal since it is better? It is important to keep in mind that a CMA is built to help buyers and sellers find a price they can offer or list at. A realtor can fairly quickly do this and for a buyer they will likely run many reports for various properties. These are quicker and often at no cost to the client. An Appraiser will take several days to deliver a report and is typically hundreds of dollars.

We do regularly see seller get an appraisal before they list just to have another opinion on price. That being said it is important to note that a buyer's lender will still request a new appraiser come out as they will require an opinion of an appraiser that is not hired by either party. This new appraiser will represent the lender's interest in the deal.

As a buyer you should avoid paying for an appraisal until you have an accepted offer. Your real estate agent can write an offer conginent on your lender's approval to ensure that you are not overpaying according to the appraisers official report. This will protect your financial interests and limit your risks.

Conclusion

You are now well equiped to embark in the world of making & recieving offers and understanding the differences between a CMA and an appraisal. If we can help you answer any further questions don't hesitate to call us at 281-786-9899 or fill out a form on our website. We'll see you at the closing table!

Categories

Recent Posts