What Price Should I Offer on A Home? | Real Estate Secrets

What Price Should I Offer on A Home?

Buying a home is a large financial decision and knowing what price to offer can make a lot of people really uncomfortable... All of that hard earned money goes so quickly and the offer price is a decision that can leave many paralized as they consider all of the options standing between their cash and their dream home. The A List Team has been at the negotiating table many times and we are going to share the secrets we have learned over time.

Key Takeaways

- Price & Terms are important to negotiate on

- There are safeguards we can write with contingencies that enable you to avoid overpaying on properties.

- Sellers are commonly concerned about how serious the buyer is or if they can close without wasting their time. If you write a solid offer showing you are serious you might get a lower price.

What to Consider Before You Offer?

Offers take a lot of thought and need to combine your personal objectives with market dynamics and the individual seller you are working with. The first question you need to look at is

How do I know if the Houston Market is a Buyer's or a Seller's Market?

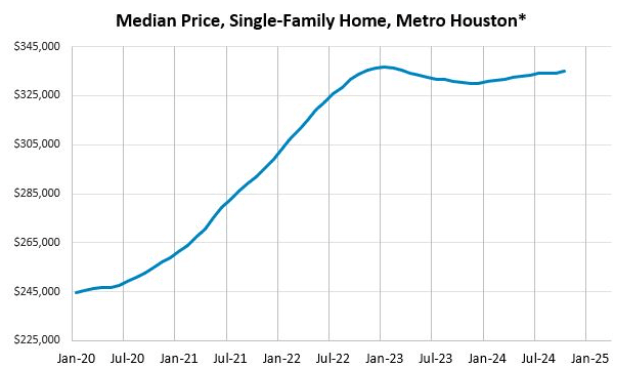

Markets can vary a lot as we saw in 2021 sellers would regularly receive more than 20 offers on a property where as by the end of 2024 it was more common to see houses sit on the market for a month or two before they get an offer. Knowing which market you are in will play largely into how aggresively you price in order to meet your needs and your timeline. Pricing is simply determined by Supply and Demand.

The greater the supply is pricing typically goes down and the lesser the demand pricing usually goes down. However if demand is high while supply is high pricing stays strong. The best way to look at this in real estate is through charts that show the number of active listings on the market and the number of transactions sold. If you want a simpler means to trend this follow the Median home price in Houston, TX and you will see what our market is doing today.

What is the condition of the home?

If a house has not had recent updates or it needs some repairs to be made you might find that the seller is more willing to work with you on price. Are you willing to put some TLC into a home to get a better price?

Seller's Motivation

This might be difficult for you to pick up from the MLS, however a real estate agent can often learn valuable information when calling a listing agent that can give us insights. If a seller is under pressure to move a property quickly for work or a move that is coming up we can often find wiggle room in negotiations. This is something we will work with you to capitalize.

Your Budget

Having a preset budget on what you will spend at closing and what you will spend monthly will help you in the heat of the moment so you don't make decisions you will regret later. We highly recommend you sit down before you start looking so that you don't get taken up in the moment when you find that dreamy house.

How do You Avoid Overpaying on a House?

No one likes getting the short end of a stick in a negotiation, so how do I know if I'm paying too much for a house? There are three main ways we work with you to ensure you are not overpaying to the value you desire.

Compareable Market Analysis (CMA)

As realtors we have access to a lot of data in Houston, TX and all of the surrounding areas. We will work on building you a report that shows what similar homes have sold for and give you a fine tune range to where a home might be valued.

Appraisal Report

You don't want to over pay and your lender also doesn't want to invest too much money in a house that could loose value. So how do lenders mitigate their risks in a home? They hire an appraiser who's only job is to determine exactly what a home is valued at. When we write our offer for your purchase we can add a contingency in your offer that says if they lender does not approve the house at your offer price you reserve the right to back out of the contract and retrieve your earnest money deposit back. More than likely the seller will realize they got a pretty good deal and they may be better off moving forward with a revised value but this measure is put in place to ensure you don't over pay for your house. Writting a contingency in your offer can be one of the surest ways to avoid overpaying on a home in Texas.

Negotiating Price & Terms

Many times sellers will be focused only on top pricing but there are ways for you to pay less money simply by leveraging the right terms and conditions in your offer. For example if you add a Seller Concession of $10,000 you can use that money to pay down out of pocket costs at closing and even pay points on your loan to lower your monthly mortgage payment!

How Much Lower Can You Negotiate a House Price?

Keep in mind that many sellers don't just want a high price, they also want to know that you are serious about buying and that you are confident to have the means to close and not flake out. Deals can fall through due to property conditions, lender requirments or a change of heart from the buyer. If the seller is in a bind for time they may be more flexible on price or cash in hand through various terms. So, what is considered a strong offer on a home? Here are our top picks:

Waive Contingencies

Most offers carry two contingenices or more. The two common ones are:

- Option Period: This is used to perform a physical inspection or take a closer look into the property and determine if the buyer is comfortable with the house as is or if they will require more work prior to closing. Seller's don't like this as it typically brings up more negotiation.

- Buyer Approval & Property Approval by Lender: This requires the lender to approve that the buyer is infact able to purchase the property and they qualify financially. It also requires that the appraiser give the buyer a value greater than or equal to the offer price. If either of these does not occur then the buyer can back out and keep their earnest money.

It is important that you understand the risks with removing these contingencies however if you are able to remove these from your offer they can set you appart from other offers and warrant a lower price. We have seen many sellers choose certainty over dollars.

Limit Your Asks

Sellers commonly pay between 7%-10% in closing costs from commissions, title insurance, HOA etc. If you can remove some common costs from their side of the expenses it shows that you are a team player and working with them.

Seller Needs

If we are able to learn more about the seller's situation we often find they may need more time to move. This leaves us open to do things like extend the closing date or offer them a lease back so they can move out on a time frame that is more desirable. Seller's also need to move to another house and they might need the proceeds of this sale to purchase their next place. If you are able to offer a lease back you may save them storage costs or airbnb costs while they navigate the time between.

From your goals to market trends and the seller's needs we are here to help you make your dream your reality. Reach out to us on our website form or give us a call (281-786-9899) to help you secure your home at the best price.

Categories

Recent Posts