Unlocking Wealth: A W2 Employee's Guide to Real Estate Investing

Unlocking Wealth: A W2 Employee's Guide to Real Estate Investing

Are you a W2 employee or a business owner looking to secure your financial future through real estate investing? In this comprehensive guide, we’ll explore proven strategies to help you build a rental property portfolio while maintaining your full-time job.

Key Takeaways

- Define your investment goals and create a clear acquisition model to achieve financial freedom through rental properties.

- Utilize equity in your properties as a strategic tool to enhance your investment portfolio and accelerate debt repayment.

- Work with a knowledgeable team, like A List Team, to navigate the complexities of real estate investing and ensure you make informed decisions.

The Importance of a Clear Plan

Having a clear plan is the cornerstone of successful rental property investing. When you define your goals and set a structured path, it becomes easier to navigate the complexities of the real estate market. Imagine having a detailed roadmap that outlines how many properties to buy each year and how much money to set aside. This structure not only reduces stress but also helps you stay focused on your long-term objectives.

In our journey, we realized that without a clear plan, we were merely reacting to opportunities rather than strategically pursuing our goals. The clarity of a well-defined plan allows you to measure your progress and adjust your strategies as needed. It transforms the overwhelming nature of real estate investing into a manageable and exciting venture.

Key Elements of a Successful Plan

-

- Define Your Income Goals: Know how much passive income you want to generate from your rental properties.

- Establish Your Investment Criteria: Determine the types of properties you are interested in, including location, size, and condition.

- Create an Acquisition Strategy: Outline how you will acquire properties, whether on-market or off-market, and the financing options you will consider.

Our Journey into Rental Property Investing

Back in 2018, my wife and I embarked on a journey that would change our financial future. We had been rental property investors for a few years, but we felt overwhelmed by our W2 jobs and family responsibilities. We knew we wanted to grow our portfolio, but we lacked direction and clarity. That's when we decided to create a structured plan based on our experiences and the insights we gained from various resources.

We set ambitious yet achievable goals: to acquire 20 doors by 2029, generating $200,000 in net revenue. By establishing this target, we could work backwards and determine how much we needed to save each year. This journey taught us the importance of aligning our investments with our personal and financial goals, ensuring that every decision contributed to our ultimate objective.

Overcoming Analysis Paralysis

One of the biggest challenges we faced was analysis paralysis. With so many strategies available, it was easy to get bogged down in details and miss out on opportunities. We found ourselves second-guessing our decisions and hesitating to act. To overcome this, we had to simplify our approach and focus on what truly mattered.

We learned to trust our research and instincts, which allowed us to make informed decisions without getting overwhelmed. By defining clear criteria for our investments, we could quickly assess potential properties and determine if they aligned with our goals. This shift in mindset was crucial in propelling our investment journey forward.

Setting Clear Financial Goals

Setting clear financial goals is crucial for any real estate investor. When we first started, our goals were vague, which made it difficult to measure our progress. We quickly learned that specificity is key. By defining exactly how much passive income we wanted to generate and by when, we could create actionable steps to achieve those targets.

We set a timeline to acquire our desired number of properties and established financial milestones along the way. This not only kept us motivated but also allowed us to celebrate small victories as we progressed towards our larger goal. Tracking our financial goals helped us stay accountable and focused on our investment strategy.

Tips for Defining Financial Goals

-

- Be Specific: Clearly articulate your financial targets, including income amounts and timelines.

- Make Them Measurable: Use metrics that allow you to track your progress over time.

- Regularly Review and Adjust: Periodically assess your goals and make adjustments as needed to reflect changes in your circumstances.

Defining Your Investment Criteria

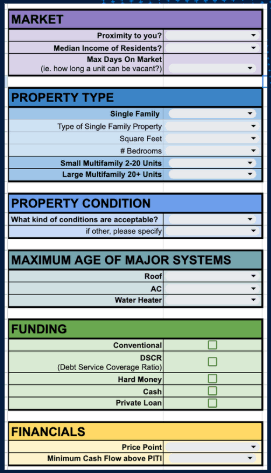

Defining your investment criteria is essential for successful property acquisitions. As an investor you need to define what types of properties you are comfortable buying and holding. Without clear guidelines, it’s easy to get sidetracked by tempting deals that don’t align with your goals. We have created a checklist to help you streamline your decisions, simplify your search and enable you to use leverage to find your deals.

We developed a comprehensive list of criteria that includes: property types, locations, property conditions, price ranges, and repairs you are willing to address. This list acts as a filter, helping us, as your realtor, quickly assess potential investments so you can make decisions that align with your overall strategy. By defining your criteria, we can focus on opportunities that meet your specifications, saving you time and reducing the stress of decision-making.

Key Components of Investment Criteria

-

- Property Type: Decide whether you prefer single-family homes, condos, or multi-family units.

- Location: Identify neighborhoods or specific areas like Katy, TX, that you want to target for investments.

- Condition: Determine the level of repairs you are willing to undertake and the age of the property.

The Acquisition Model: Step-by-Step

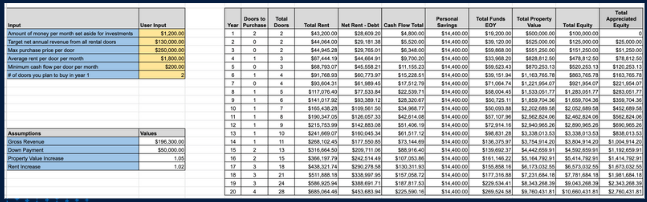

The acquisition model is the backbone of a successful rental property investment strategy. We built a model that structures a path to your goal by entering a few well guided inputs.

It starts with defining your income goals, which will guide your investment decisions. For example, if your goal is to generate $200,000 in net revenue from your rental properties, you need to work backwards to determine how many properties you need to acquire and the average rent per property.

Next, establish your financial capacity. Assess how much disposable income you can allocate towards property investments each month. This will help you determine how much you can save and invest over time.

Utilizing Equity for Growth

Equity is a powerful tool in real estate investing. As your properties appreciate over time, the equity you build can be leveraged for further investments. For instance, if you own a property in Katy, TX, that has appreciated significantly, you could sell it or refinance to access that equity. This capital can then be used to acquire additional properties, allowing you to expand your portfolio without needing to rely solely on your W2 income.

Moreover, using equity can also help you pay off existing debts on properties. By strategically selling or refinancing, you can reduce your overall debt load while still maintaining a robust investment strategy. This dual approach not only accelerates your path to financial freedom but also enhances your overall return on investment.

Strategies for Paying Off Debt

Paying off debt is a critical component of any real estate investment strategy. There are multiple approaches you can take to achieve this goal. First, consider using the cash flow generated from your rental properties to make additional payments on your mortgages. This can significantly reduce the time it takes to pay off your debt and increase your equity in the long run.

Another strategy is to leverage your equity for debt repayment. If you have properties with substantial appreciation, consider selling or refinancing to access that equity. This can provide you with the funds needed to pay off mortgages on other properties, thereby simplifying your financial situation.

Finally, always keep an eye on market conditions. If you anticipate appreciation in certain areas, it may be beneficial to hold onto properties longer and allow them to increase in value before making significant debt repayments. This strategy maximizes your potential returns while providing flexibility in your financial planning.

Understanding the Role of Models in Investing

Models serve as a roadmap for investors, guiding them through the complexities of real estate. While all models are inherently imperfect, they provide a framework for making informed decisions. For example, a well-structured model will outline your income goals, acquisition strategies, and criteria for selecting properties, helping you navigate potential pitfalls.

It's essential to recognize that models are not static; they should be adjusted as market conditions change. If you're facing unforeseen challenges, like fluctuating interest rates, your model should adapt to reflect these changes. This flexibility allows you to remain on track towards your goals, regardless of external factors.

In essence, a solid model can help you overcome analysis paralysis, streamline your investment process, and ultimately lead you to success in real estate investing.

How the A List Team Can Help You

The A List Team is here to support you on your real estate investment journey. As experienced realtors and investors ourselves, we understand the intricacies of the market and can help you navigate the complexities of property acquisition. Our team can assist you in establishing a realistic investment strategy tailored to your goals and financial capacity.

We also provide valuable insights into market trends, helping you identify the best neighborhoods and property types for investment. Whether you’re looking to invest in single-family homes or multi-family units, we can guide you through the process with confidence.

Additionally, we have access to off-market deals and can streamline your offer process with our templates, making it easier for you to find and secure properties that meet your criteria. Let us help you turn your real estate aspirations into reality.

If you have questions about rental property investing or are looking for guidance on how to get started, we encourage you to reach out to us. Our team is ready to assist you in navigating the exciting world of real estate investing. Together, we can create a strategy that aligns with your financial goals and leads you towards financial freedom.

Categories

Recent Posts